UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☑ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to 240.14a-12 |

Chemed Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY16, 201620, 2019

MAY

The Annual Meeting of Stockholders of Chemed Corporation will be held at The Queen City Club, 331 East Fourth Street, Cincinnati, Ohio, on May 16, 2016,20, 2019, at 11:00 a.m. Eastern Time for the following purposes:

| (1) | To elect directors; |

| To ratify the selection of independent accountants by the Audit Committee of the Board of Directors; |

| To hold an advisory vote to approve executive compensation; |

| (4) | To consider a stockholder proposal requesting a semi-annual report on (a) the Company’s policies on political spending and (b) political contributions made; and |

| (5) | To transact any other business properly brought before the meeting. |

The above matters are described in the Proxy Statement accompanying this Notice. You are urged, after reading the Proxy Statement, to vote your shares by proxy by either: (a) completing, signing, dating and returning your proxy card in the postage-paid envelope provided, or (b) voting by telephone, or (c) voting via the Internet using the instructions on your proxy card. Voting instructions are described in more detail in the Proxy Statement.

Your vote is extremely important. If you have any questions or require any assistance with voting your shares, please contact the Board of Directors’ proxy solicitor:

Innisfree M&A Incorporated

Stockholders Toll-Free: (888) 750-5834

Banks and Brokers Collect: (212) 750-5833

Stockholders of record at the close of business on March 28, 2016,26, 2019 are entitled to notice of, and to vote at, the Annual Meeting.

Naomi C. Dallob | |

Secretary |

April 7, 20169, 2019

Table of Contents

| PAGE | ||

CONSIDERATION OF | 1 | |

2018 COMPENSATION | 1 | |

| 1 | ||

PROXY STATEMENT | 4 | |

| Stockholders Entitled to Vote | 4 | |

| Quorum | 4 | |

| Vote Requirements | 5 | |

| How to Vote | 5 | |

PROPOSAL 1 – ELECTION OF DIRECTORS | ||

| General | ||

| Nominees | 7 | |

| Recommendation | 9 | |

CORPORATE GOVERNANCE | 9 | |

| Narrative Disclosure to Director Compensation Table | 9 | |

| Directors Emeriti | ||

| Majority Voting in Director Elections | 11 | |

| Procedures Regarding Director Candidates Recommended by Stockholders | ||

| Director Independence | ||

| Board Risk Oversight | 13 | |

| Compensation Risk | ||

| Compensation Committee Interlocks and Insider Participation | ||

| Board Leadership Structure; Related Person Transactions | ||

| Code of Ethics | ||

| Stockholder Communications | ||

COMPENSATION DISCUSSION AND ANALYSIS | ||

| Consideration of the | ||

| Overview of Compensation Program | ||

| How Compensation Decisions are Made | ||

| Role of Executive Officers | ||

| Objectives of Compensation Program | 17 | |

| Elements of Executive Compensation | ||

| Executive Compensation Consultant, Independence | ||

| Peer Group | ||

| Base Salaries | ||

| Annual Non Equity Incentive Compensation | ||

| Long-Term Incentives | ||

| Retirement Benefits | ||

| Tax Considerations | 24 | |

| Employment Agreements | ||

| Stock Ownership Guidelines | ||

REPORT OF THE COMPENSATION COMMITTEE | 26 | |

EXECUTIVE COMPENSATION | ||

| Summary Compensation | ||

| All Other Compensation Table | ||

| Grants of Plan-Based Awards | ||

| Narrative | ||

| Employment Agreements | ||

| Annual Cash Incentives | ||

| Stock Incentive Plans | ||

| Outstanding Equity Awards at Fiscal Year End | ||

| Option Exercises and Stock Vested | ||

| Nonqualified Deferred Compensation | ||

| Excess Benefit Plan and Deferred Compensation Plan | ||

| Potential Payments Upon Termination or Change in Control | ||

| Executive Pay Ratio | 43 | |

TRANSACTIONS WITH RELATED PERSONS | ||

SECURITY OWNERSHIP | ||

| Security Ownership of Certain Beneficial Owners | ||

| Security Ownership of Executive Officers and Directors | ||

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||

CLAWBACK POLICY | ||

ANTI-HEDGING POLICY | ||

PROPOSAL 2 – | ||

| 46 | ||

| Recommendation | ||

| 47 | ||

PROPOSAL | 48 | |

| Recommendation | 49 | |

PROPOSAL 4 – STOCKHOLDER PROPOSAL ON POLITICAL SPENDING | 49 | |

| Recommendation | 51 | |

PROPOSALS FOR THE NEXT ANNUAL MEETING | ||

| Proposals to be Included in Our | ||

| Stockholder Proposals Regarding Nominations or Other Business at the | ||

IMPORTANT NOTICE REGARDING AVAILABILITY OF | ||

PROXY MATERIALS FOR ANNUAL MEETING | ||

OTHER INFORMATION | ||

Consideration of the 20152018 Say On Pay Vote

Following our 20152018 Annual Meeting of Stockholders, the Compensation Committee and the Board of Directors reviewed the results of the non-binding stockholder advisory vote on our executive compensation (“20152018 Say On Pay Vote”). Stockholders voted in favor of Say On Pay, with 79.48%95.50% positive votes, 19.76%4.09% negative votes, and .76% abstentions..40% abstentions (results rounded to the nearest hundredth of a percent). Given the strong vote in favor, the Company continued its ongoing communication with stockholders and maintained its executive compensation policies and practices, includingthat include the following changes it implemented in 2013 as followsfrom earlier practices (abbreviated terms are defined within):

| Replacement of the previous annual incentive program, which was based on a multiple of historical growth rates in Adjusted EPS applied to prior year actual payouts, with a target bonus plan based on achieving goals related to Adjusted EPS and Return on Assets; |

| Replacement of the previous long-term incentive plan with performance share units subject to performance-based vesting related to a cumulative three-year Adjusted EPS target and a three-year relative TSR performance metric. Prior to 2013, time-based restricted stock awards generally cliff vested on the fourth anniversary of the grant date; |

| A policy that, beginning in 2013, stock incentive compensation is subject to a “double trigger” in the event of a change in control of the Company. New incentives vest only upon employment termination without good cause or for good reason after a change in control; and |

| A clawback policy such that the Compensation Committee will review all performance-based compensation awarded to or earned by certain officers during the three-year period prior to any restatement of the Company’s financial results. If the Compensation Committee determines such compensation would have been lower had it been calculated based on the restated financial statement, the Compensation Committee may seek to recover the excess amount. |

| ● | Additionally, in 2018, the Board of Directors amended The Senior Executive Severance Policy and the Change in Control Plan to limit any gross-up payments payable under the plans to the then-existing participants in the plans. |

Management maintains a policy of soliciting feedback in connection with the Say On Pay vote and changes to the executive compensation program from a number of its largest stockholders.

The Compensation Committee and the Board believesbelieve that our executive compensation program provides our executive officers with a balanced compensation package that includes a reasonable base salary along with annual and long-term incentive compensation plans that are based on the Company’s financial performance. We believe the shareholder approval in 2018 further validates our executive compensation program. For 2015,2018, about 6472.9 percent of our President and Chief Executive Officer’s actual total direct compensation was performance-based, while the average for the other named executive officers was about 6070.2 percent. “Performance-based” compensation includes non-non equity incentive awards, option awards, and performance share unit awards.

2018 Performance

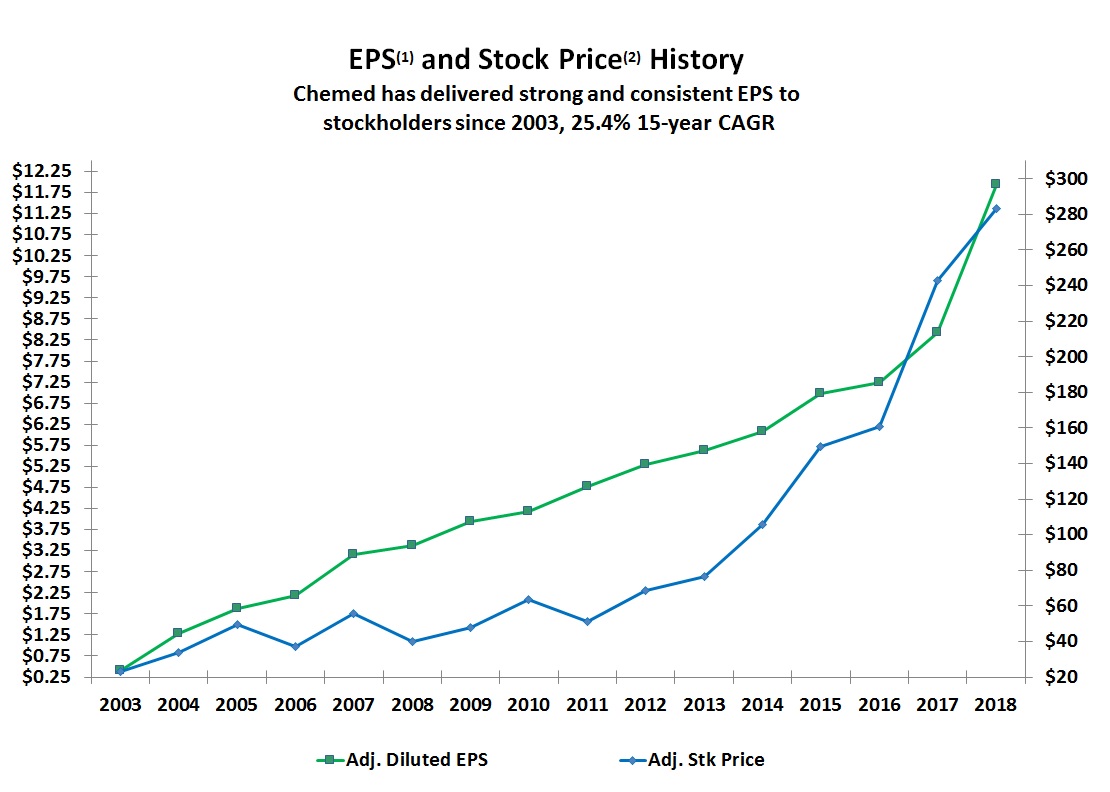

The following chart summarizes both Chemed’s Adjusted EPS and stock price performance since 2003.

1

(1) Adjusted Diluted EPS; See next page for reconciliation from GAAP reported results to adjusted (non-GAAP) results |

(2) Adjusted for stock split |

2

CHEMED CORPORATION

FOR THE YEARS ENDED DECEMBER 31, 2003 THROUGH 2015RECONCILIATION OF ADJUSTED NET INCOMECHEMED CORPORATION 3 2018

(IN THOUSANDS)

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Reconciliation of Adjusted Net Income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Net income/(loss) | $ | (3,435 | ) | $ | 27,512 | $ | 35,817 | $ | 50,651 | $ | 61,641 | $ | 67,281 | $ | 73,784 | $ | 81,831 | $ | 85,979 | $ | 89,304 | $ | 77,227 | $ | 99,317 | $ | 110,274 | $ | 108,743 | $ | 98,177 | $ | 205,544 | ||||||||||||||||||||||||||||||||

| Add/(deduct): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | Discontinued operations | 14,623 | (8,417 | ) | 411 | 7,071 | (1,201 | ) | 1,088 | 253 | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||

| (3) | (Gains)/losses on investments | (3,351 | ) | - | - | 918 | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | Gain on sale of property | - | - | - | - | (724 | ) | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | Impairment loss on transportation equipment | - | - | - | - | - | 1,714 | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (6) | Severance charges | 2,358 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (7) | Dividend income from VITAS | (1,379 | ) | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (8) | Equity in earnings of VITAS | (922 | ) | 4,105 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (9) | Long-term incentive compensation | - | 5,437 | 3,434 | - | 4,427 | - | 3,134 | 2,957 | 1,880 | 228 | 822 | 1,625 | 4,752 | 1,221 | 3,243 | 5,307 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (10) | Loss/(gain) on extinguishment of debt | - | 2,030 | 2,523 | 273 | 8,778 | (2,156 | ) | - | - | - | - | 294 | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (11) | Legal expenses of OIG investigation | - | - | 397 | 662 | 141 | 28 | 363 | 627 | 737 | 752 | 1,333 | 1,328 | 3,072 | 3,248 | 3,207 | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (12) | Stock option expense | - | - | 137 | 769 | 2,962 | 4,619 | 5,464 | 4,909 | 5,298 | 5,143 | 3,813 | 3,022 | 3,439 | 5,266 | 6,892 | 10,118 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (13) | Lawsuit settlement | - | 1,897 | 10,757 | 169 | 1,168 | - | 534 | 1,126 | 1,397 | 617 | 16,926 | 74 | 3 | 28 | 52,504 | 594 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (14) | Prior period tax adjustments | - | (1,620 | ) | (1,961 | ) | (2,115 | ) | - | (322 | ) | - | - | - | - | (1,782 | ) | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| (15) | Debt registration expenses | - | 727 | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (16) | VITAS transactions costs | - | 222 | (959 | ) | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (17) | Prior period insurance adjustments | - | - | (1,014 | ) | - | - | 358 | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (18) | Non-cash interest on convertible debt | - | - | - | - | 2,335 | 3,228 | 3,988 | 4,313 | 4,664 | 5,041 | 5,448 | 2,143 | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (19) | Income tax impact of non-taxable investments | - | - | - | - | 46 | 3,062 | (756 | ) | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (20) | Expenses associated with contested proxy solitication | - | - | - | - | - | - | 2,525 | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (21) | Acquisition Expenses | - | - | - | - | - | - | - | 198 | 75 | 114 | 38 | 15 | 104 | - | - | 559 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (22) | Costs to Shut down HVAC operations | - | - | - | - | - | - | - | - | - | 649 | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (23) | Securities litigation | - | - | - | - | - | - | - | - | - | 469 | 69 | 207 | 23 | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (24) | Severance arrangements | - | - | - | - | - | - | - | - | - | - | 184 | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (25) | Early retirement expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | 2,840 | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (26) | Medicare cap sequestration adjustment | - | - | - | - | - | - | - | - | - | - | - | - | - | 141 | 276 | 1,114 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (27) | Other | - | - | - | (296 | ) | (296 | ) | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||

| (28) | Excess tax benefits on stock compensation | - | - | - | - | - | - | - | - | - | - | - | - | - | - | (18,932 | ) | (22,862 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| (29) | Impact of tax reform | - | - | - | - | - | - | - | - | - | - | - | - | - | - | (8,302 | ) | - | ||||||||||||||||||||||||||||||||||||||||||||||||

| (30) | Loss on sale of transportation equipment | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 3,314 | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (31) | Program closure expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 675 | - | |||||||||||||||||||||||||||||||||||||||||||||||||

| (32) | Adjusted net income | $ | 7,894 | $ | 31,893 | $ | 49,542 | $ | 58,102 | $ | 79,277 | $ | 78,900 | $ | 89,289 | $ | 95,961 | $ | 100,030 | $ | 102,317 | $ | 104,372 | $ | 107,731 | $ | 121,667 | $ | 121,487 | $ | 141,054 | $ | 200,374 | |||||||||||||||||||||||||||||||||

3

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are furnished in connection with the solicitation by the Board of Directors (the “Board” or the “Board of Directors”) of Chemed Corporation (the “Company” or “Chemed”) of proxies to be used at the Annual Meeting of Stockholders of the Company to be held at 11:00 a.m. Eastern Time at The Queen City Club, 331 East Fourth Street, Cincinnati, Ohio, on May 16, 201620, 2019 (the “Annual Meeting”), and any adjournments or postponements thereof. The Company’s mailing address is Suite 2600, 255 East Fifth Street, Cincinnati, Ohio 45202-4726. The approximate date on which this Proxy Statement and the enclosed proxy card are first being given or sent to stockholders is April 7, 2016.9, 2019.

The Board unanimously recommends that you vote FOR the election of each of the Board’s nominees named on the proxy card accompanying this Proxy Statement.Please read “How to Vote” for more information on how to vote your proxy.

STOCKHOLDERS ENTITLED TO VOTE

Stockholders as recorded in the Company’s stock register on March 28, 2016,26, 2019, will be entitled to notice of and may vote at the Annual Meeting or any adjournments or postponements thereof. On such date, the Company had outstanding 16,632,17615,934,144 shares of capital stock, par value $1 per share (“Capital Stock”), entitled to one vote per share. The list of stockholders entitled to vote at the meeting will be open to the examination of any stockholder for any purpose relevant to the meeting during normal business hours for 10 days before the meeting at the Company’s office in Cincinnati. The list will also be available during the meeting for inspection by stockholders.

QUORUM

The Company’s bylaws provide that at all meetings of stockholders, the holders of record, present in person or by proxy, of shares of Capital Stock having a majority of the voting power entitled to vote thereat, is necessary and sufficient to constitute a quorum for the transaction of business. Abstentions and shares held of record by a broker or its nominee that are voted on any matter are included in determining the number of votes present. Broker shares that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present.

Your vote is important – we urge you to vote by proxy even if you plan to attend the Annual Meeting.

4

VOTE REQUIREMENTS

Proposal | Vote Required | Voting Options | Effect of Abstentions | Broker Discretionary Voting Allowed? | Effect of Broker Non-Votes | Recommended Vote |

Election of Directors (Proposal 1) | Votes cast for exceed votes cast against | FOR, AGAINST or ABSTAIN | No effect, not treated as a “vote cast” | No | No effect, not treated as a “vote cast” | FOR |

Majority of shares with voting power present in person or represented by proxy | FOR, AGAINST or ABSTAIN | Treated as a vote AGAINST the | Yes | Not applicable | FOR | |

Non-Binding Advisory Vote on Executive Compensation (Say On Pay) (Proposal 3) | Majority of shares with voting power present in person or represented by proxy | FOR, AGAINST | ||||

or ABSTAIN | Treated as a vote AGAINST the proposal | No | No effect – not entitled to vote | FOR | ||

Stockholder Proposal Regarding Political Spending (Proposal 4) | Majority of shares with voting power present in person or represented by proxy | FOR, AGAINST or ABSTAIN | Treated as a vote AGAINST the proposal | No | No effect – not entitled to vote | AGAINST |

HOW TO VOTE; SUBMITTING YOUR PROXY; REVOKING YOUR PROXY

You may vote your shares either by voting in person at the Annual Meeting or by submitting a completed proxy. By submitting a proxy, you are legally authorizing another person to vote your shares. The enclosed proxy card designates Messrs. McNamara and Walsh to vote your shares in accordance with the voting instructions you indicate on your proxy card.

If you submit your executed proxy card designating Messrs. McNamara and Walsh as the individuals authorized to vote your shares, but you do not indicate how your shares are to be voted, then your shares will be voted by these individuals in accordance with the Board’s recommendations, which are described in this Proxy Statement. In addition, if any other matters are properly brought up at the Annual Meeting (other than the proposals contained in this Proxy Statement), then each of these individuals will have the authority to vote your shares on those other matters in accordance with his or her discretion and judgment. The Board currently does not know of any matters to be raised at the Annual Meeting other than the proposals contained in this Proxy Statement.

We urge you to vote by doing one of the following:

Vote by Mail: You can vote your shares by mail by completing, signing, dating and returning your proxy card in the postage-paid envelope provided. In order for your proxy to be validly submitted and for your shares to be voted in accordance with your instructions, we must receiveyour mailed proxy card by 11:59 p.m. Central Time on May |

Vote by Telephone: You can also vote your shares by calling the number (toll-free in the United States and Canada) indicated on your proxy card at any time and following the recorded instructions. If you submit your proxy by telephone, then you may submit your voting instructions up until 11:59 p.m. Central Time on May |

Vote via the Internet: You can vote your shares via the Internet by going to the Web site address for Internet voting indicated on your proxy card and following the steps outlined on the secure Web site. If you submit your proxy via the Internet, then you may submit your voting instructions up until 11:59 p.m. Central Time on May |

5

If your shares are not registered in your name but in the “street name” of a bank, broker or other holder of record (a “nominee”), then your name will not appear in the Company’s register of stockholders. Those shares are held in your nominee’s name, on your behalf, and your nominee will be entitled to vote your shares. Your nominee is required to vote your shares in accordance with your instructions. If you do not give instructions to your nominee, your nominee will be entitled to vote your shares with respect to “discretionary” items but will not be permitted to vote your shares with respect to “non-discretionary” items (your shares are treated as “broker non-votes”).

Your proxy is revocable. If you are a stockholder of record, after you have submitted your proxy card, you may revoke it by mail by sending a written notice to be delivered before the Annual Meeting to the Company’s Secretary at Suite 2600, 255 East Fifth Street, Cincinnati, Ohio 45202-4726. If you wish to revoke your submitted proxy card and submit new voting instructions by mail, then you must sign, date and mail a new proxy card with your new voting instructions, which we must receive by 11:59 p.m. Central Time on May 15, 2016.19, 2019. If you are a stockholder of record and you voted your proxy card by telephone or via the Internet, you may revoke your submitted proxy and/or submit new voting instructions by that same method, which we must receive by 11:59 p.m. Central Time on May 15, 2016.19, 2019. You also may revoke your proxy card by attending the Annual Meeting and voting your shares in person. Attending the Annual Meeting without taking one of the actions above will not revoke your proxy. If you are a beneficial owner, or you hold your shares in “street name” as described above, please contact your bank, broker or other holder of record for instructions on how to change or revoke your vote.

Your vote is very important to the Company. If you do not plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your completed proxy card prior to the Annual Meeting in accordance with the above instructions so that your shares will be represented and voted in accordance with your instructions. Even if you plan to attend the Annual Meeting in person, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

You are entitled to attend the Annual Meeting only if you are a stockholder of record or a beneficial owner as of the close of business on March 28, 2016,26, 2019, or if you hold a valid proxy for the meeting. You should be prepared to present photo identification for admission.

If your shares are held in “street name”, in order for you to attend the Annual Meeting, you must bring a letter or account statement showing that you beneficially own the shares held by your nominee, as well as proper photo identification. Note that evenEven if you attend the Annual Meeting, you cannot vote the shares that are held by your nominee unless you have a proxy from your nominee. Rather, you should vote your shares by following the instructions provided on the enclosed proxy card and returning the proxy card to your nominee to ensure that your shares will be voted on your behalf, as described above.

If you have questions or require any assistance with voting your shares, please contact the Board’s proxy solicitor, Innisfree M&A Incorporated: stockholdersstockholders toll-free (888) 750-5834; banks and brokers collect (212) 750-5833.

ELECTION OF DIRECTORS

In the election of directors, every stockholder has the right to vote each share of Capital Stock owned by such stockholder on the record date for as many persons as there are directors to be elected. Ten directors are to be elected at the Annual Meeting to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified in accordance with our bylaws. Cumulative voting is not permitted. To be elected in an uncontested election, each director must receive the affirmative vote of the majority of the votes cast at the Annual Meeting. The number of votes cast “FOR” a nominee’s election must exceed the number of votes cast ‘AGAINST’“AGAINST” his or her election. Abstentions and broker non-votes shall not be counted as votes cast.

6

As required by the Company’s bylaws, each incumbent director nominee has submitted an irrevocable letter of resignation as director that becomes effective if he or she does not receive the affirmative vote of the majority of the votes cast at the Annual Meeting and the Board of Directors accepts the resignation. If an incumbent director is not re- elected,re-elected, the Nominating Committee will consider the director’s resignation and recommend to the Board of Directors the action to be taken with respect to such resignation. The Board of Directors will decide the action to be taken with respect to such resignation no later than 90 days following the certification of the voting results. The Company will publicly disclose the Board of Directors’ decision within four business days, providing an explanation of the process by which the Board reached their decision and, if applicable, the reason for not accepting the director’s resignation. Any director whose resignation is so evaluated and decided upon will not participate in the Nominating Committee’s recommendation or Board of Directors’ action regarding whether to accept the resignation offer.

NOMINEES

Unless otherwise indicated by your proxy card, if you return a validly completed and executed proxy card or vote your proxy card by telephone or via the Internet, your shares will be voted FOR the nominees named below. Each of the nominees named below is a current director standing for re-election, and each was elected at the Annual Meeting of Stockholders held on May 18, 2015.21, 2018. As of the date of this Proxy Statement, the Board has no reason to believe that any of the nominees named below will be unable or unwilling to serve. Each nominee named below has consented to being named in this Proxy Statement and to serve if elected.

The following paragraphs provide information as of the date of this proxy statement about each nominee. As discussed in “Corporate Governance – Committees and Meetings of the Board – Nominating Committee” below, the Board seeks independent directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. Candidates shall have substantial experience or shall have achieved a high level of distinction in their fields. Certain individual qualifications and skills of our nominees that contribute to the Board’s effectiveness as a whole in performing its oversight responsibilities are described below.

Kevin J. McNamara Director since 1987 Age: | Mr. McNamara’s experience, qualifications, attributes and skills include serving as President and Chief Executive Officer of the Company. He has held these positions since August 1994 and May 2001, respectively. Previously, he served as Executive Vice President, Secretary and General Counsel from November 1993, August 1986 and August 1986, respectively, to August 1994. |

Joel F. Gemunder Director since 1977 Age: | Mr. Gemunder’s experience, qualifications, attributes and skills include having served as President and Chief Executive Officer of Omnicare, Inc., Cincinnati, Ohio (healthcare products and services) (“Omnicare”). Omnicare, a former Fortune 500 Company acquired by CVS Health Corporation in 2015, is a leading provider of pharmaceutical and related services for seniors serving residents of skilled nursing, assisted living, and other healthcare facilities across the United States. He retired from these positions in August 2010, having served since May 1981 and May 2001, respectively. Omnicare is a former equity investee of the Company that became a publicly owned corporation in 1981 and has not been a Chemed affiliate since at least 1996. He was a director of Omnicare until his August 2010 |

7

Patrick P. Grace Director since 1996 Age: | Mr. Grace’s experience, qualifications, attributes and skills include serving in various executive positions at W.R. Grace & Co. from 1977 to 1995, most recently as President and CEO of Grace Logistics, Inc., an operating company with oversight responsibility for Grace’s $5.0 billion global supply chain. He is currently President and CEO of Grace Institute Foundation. From 1996 to |

Thomas C. Hutton Director since 1985 Age: | Mr. Hutton’s experience, qualifications, attributes and skills include serving as a Vice President of the Company. He has held this position since February 1988. Previously, Mr. Hutton, who has a J.D. and Master’s of Public Administration degree from Cornell University, practiced corporate law in New York concentrating in securities and regulatory law from 1977 to 1987. He served as a director of Omnicare from May 1983 to May 2001. Currently Mr. Hutton serves as a trustee on three private foundations including the Chemed Foundation. |

Walter L. Krebs Director from May 1989 to April 1991, May 1995 to May 2003 and since May 2005 Age: | Mr. Krebs’ experience, qualifications, attributes and skills include having served as Senior Vice President-Finance, Chief Financial Officer and Treasurer of Service America Systems, Inc. (home and service warranties), a then-wholly owned subsidiary of the Company (“Service America”). We sold Service America in 2005. He retired from this position in July 1999, having held the position since October 1997. Previously, he was a Director-Financial Services of DiverseyLever, Inc. (formerly known as Diversey Corporation), Detroit, Michigan (specialty chemicals) (“Diversey”), from April 1991 to April 1996. Previously, from January 1990 to April 1991, he was Senior Vice President and the Chief Financial Officer of the Company’s then-wholly owned subsidiary, DuBois Chemicals, Inc. (specialty chemicals) (“DuBois”). We sold DuBois in 1991. |

Andrea R. Lindell Director since May 2008 Age: | Ms. Lindell’s experience, qualifications, attributes and skills include having served as Dean and a Professor of the College of Nursing at the University of Cincinnati. She retired from these positions in January 2011 having held them since December 1990. She is currently Professor Emeritus at the college. Since January 2016 she has served as Dean, having held the title of Associate Dean from January 2013 to January 2016, previously holding the title of Interim Associate Dean from August 2011, at the School of Nursing, Walden University. She is also Vice-Provost of Walden’s College of Health Sciences. Walden offers online degrees as follows: BSN, MSN, DNP. Ms. Lindell was also Associate Senior Vice President of the Medical Center at the University of Cincinnati from July 1998 until January 2011. The College of Nursing’s programs include over 1,500 students, and offer the following degrees: BSN, MSN, Post MSN, and PhD. From September 1994 to June 2002, she also held an additional position as Founder and Interim Dean of the College of Allied Health Sciences at the University of Cincinnati. She was a director of Omnicare until May 2014. |

8

Thomas P. Rice Director since May 2009 Age: | Mr. Rice’s experience, qualifications, attributes and skills include having served as Chief Executive Officer of Andrx Corporation, Fort Lauderdale, Florida (specialty pharmaceuticals) (“Andrx”), from February 2004 to November 2006, when Andrx was sold to Watson Pharmaceuticals. Following the sale, Mr. Rice returned as General Manager and Majority Partner of Columbia Investments LLC, Baltimore, Maryland, which invests in local emerging businesses in Baltimore and which Mr. Rice co-founded in January 1996. He was also a Director of Par Pharmaceuticals, Woodcliff Lake, NJ (drug development, manufacture, and marketing) until November 2012. From January 1999 to March 2003, he was President and Chief Executive Officer of Chesapeake Biological Laboratories, Inc., Solomons, Maryland (pharmaceuticals manufacturing) (“Chesapeake”). Before co-founding Columbia Investments LLC, Mr. Rice served as Executive Vice President and Chief Operating Officer of Circa Pharmaceuticals, Inc., Copiague, New York (pharmaceuticals manufacturing) (“Circa”), from June 1993 to January 1996. Mr. Rice was also the Chief Financial Officer of Circa from June 1993 to January 1995. Prior to joining Circa, Mr. Rice spent seven years as an accountant with Deloitte & Touche LLP, an international accounting firm. He earned a Master’s degree in finance from Loyola University. He was a director of Circa from June 1993 to January 1996, a director of Chesapeake from January 1997 to January 1999 and a director of Andrx from April 2003 to November 2006. |

Donald E. Saunders Director from May 1981 to May 1982, May 1983 to May 1987 and since May 1998 Age: | Mr. Saunders’ experience, qualifications, attributes and skills include having served as a Professor at the Farmer School of Business, Miami University, Oxford, Ohio. He held this position from August 2001 until his retirement in January 2015. Miami University is a public university with a student population of 16,000. He earned a doctorate in Economics, with a minor in Accounting, from Indiana University. He has taken Masters level courses in financial reporting, financial valuation, and risk management. Mr. Saunders retired as President of DuBois, then a division of Diversey, in October 2000, having held that position since November 1993. |

George J. Walsh III Director since 1995 Age: | Mr. Walsh’s experience, qualifications, attributes and skills include serving as a partner with the law firm of Thompson Hine LLP, New York, New York. He has held this position since May 2002. Prior to this date, Mr. Walsh was a partner with the law firm of Gould & Wilkie LLP, New York, New York, and held this position since January 1979. Gould & Wilkie merged with Thompson Hine on May 1, 2002. Mr. Walsh was elected the Chairman of the Board of Directors in March 2009. |

Frank E. Wood Director since 2002 Age: | Mr. Wood’s experience, qualifications, attributes and skills include serving since 1994 as President and Chief Executive Officer of SecretWorks, LLC (“Secret”), Cincinnati, Ohio. Secret was in the radio broadcast business, but following the sale of radio stations, it is now a venture capital company. Investments have included banking, internet security, anti-counterfeiting, meat exporting, medical office advertising, magazine publishing, and aviation. Mr. Wood is a graduate of Harvard College and earned a J.D. degree from The University of Chicago Law School. |

The Board unanimously recommends that you vote FOR the election of each of the above-named nominees.

CORPORATE GOVERNANCE

Director Compensation

The Company’s compensation program for directors who are not employees of the Company consists of annual cash fees and fully vested stock awards granted pursuant to the Chemed Corporation 2006 Stock Incentive Plan (as amended, supplemented or otherwise modified as of the date hereof, the “2006 Incentive Plan”) and the Chemed Corporation 2010 Stock Incentive Plan (as amended, supplemented or otherwise modified as of the date hereof, the “2010 Incentive Plan”), the Chemed Corporation 2015 Stock Incentive Plan (as amended, supplemented or otherwise modified as of the date hereof, the “2015 Incentive Plan”) and the Chemed Corporation 2018 Stock Incentive Plan (as amended, supplemented or otherwise modified as of the date hereof, the “2018 Incentive Plan”). Directors who are not employees of the Company may also participate in the Chemed Corporation Deferred Compensation Plan for Non-Employee Directors (the “Director Deferred Compensation Plan”), which is described below. Directors who are employees of the Company do not receive cash compensation for their service as directors, and do not receive annual fully vested stock awards for such service.service.

9

The Board reviews and sets the cash compensation and fully vested stock awards for non-employee directors.directors, based on recommendation of the Compensation/Incentive Committee (the “Compensation Committee”). In making its determination, the Board seeks input from the Compensation Committee’s independent compensation consultant, Compensation Strategies, Inc., as well as certain executive officers of the Company, and considers any such input, including as to the level of compensation necessary to attract and retain qualified directors, among the factors it reviews in setting the amount of compensation. Director compensation is reviewed annually. It was most recently reviewed by the Board (with input from Compensation Strategies, Inc.) in May of 2014.2018, in light of current peer group constituency and market data.

Each member of the Board of Directors who is not an employee of the Company is paid an annual fee of $55,000. Directors also receive a fee of $3,000 for each Board meeting attended. Non-employee directors also received annual fully vested stock awards in the amount of $60,023.$85,000, increased from $60,000 on May 15, 2017. Mr. Walsh is paid an additional annual fee of $145,000 for his service as Chairman of the Board. Each member of the Board’s Audit Committee (other than its chairman), Compensation/IncentiveCompensation Committee (the “Compensation Committee”) (other than its chairman) and Nominating Committee (including(other than its chairman) is paid an additional annual fee of $10,000, $7,000 and $7,000, respectively, for his or her service on that Committee. The chair of the Audit Committee is paid $25,000 per year, and the chair of the Compensation Committee is paid $15,000 per year, effective May 15, 2017, increased from $7,500, and the chair of the Nominating Committee is paid $10,000, effective May 15, 2017, increased from $7,000 per year. A Committee member also is paid $1,000 for each Committee meeting (other than meetings of the Nominating Committee) attended unless the Committee meeting is on the same day as a meeting of the Board of Directors, in which case Committee members are paid $500 for attendance at the Committee meeting. Messrs. McNamara and Hutton, who are employees of the Company, do not receive compensation for their service as directors. Each member of the Board of Directors and of a Committee is additionally reimbursed for continuing education expenses and reasonable travel expenses incurred in connection with attendance at Board and Committee meetings. No Compensation Committee member received any compensation from the Company other than as a director.

In May 2015,2018, Messrs. Gemunder, Grace, Krebs, Rice, Saunders, Walsh and Wood and Ms. Lindell each received $60,023$85,106 in the form of a fully vested stock award of 493255 shares of Capital Stock.

In addition, the Company maintains the Director Deferred Compensation Plan in which certain directors who are not employees of the Company or of a subsidiary of the Company participate. Under such plan, which is not a tax- qualifiedtax-qualified plan, an account is established for each participant to whom amounts are credited quarterly at the rate of $6,000 per year. These amounts are used to purchase shares of Capital Stock, and all dividends are reinvested in Capital Stock. Each participant is entitled to receive the balance in his or her account within 90 days following the date he or she ceases to serve as a director. In 2015,2018, each of Messrs. Gemunder, Grace, Krebs, Rice, Saunders, Walsh and Wood and Ms. Lindell received contributions of $6,000, in each case in his or her respective account in the Director Deferred Compensation Plan.

Directors may participate in the Company’s health insurance plans by paying rates offered to former employees under COBRA, and may use available space, on a non-exclusive basis, in the Company’s New York office.

10

In 2015,2018, the Company provided the following compensation to directors and directors emeriti for their service to the Company:

DIRECTOR COMPENSATION-2015COMPENSATION - 2018 (a)

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(b) | All Other Compensation ($) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(b) | All Other Compensation ($) | Total ($) | ||||||||

| Joel F. Gemunder | 80,000 | 66,023 | - | 146,023 | 81,000 | 91,106 | - | 172,106 | ||||||||

| Patrick P. Grace | 95,500 | 66,023 | - | 161,523 | 115,500 | 91,106 | - | 206,606 | ||||||||

| Walter L. Krebs | 82,000 | 66,023 | - | 148,023 | 82,000 | 91,106 | - | 173,106 | ||||||||

| Sandra E. Laney | 20,500 | 66,023 | - | 86,523 | 20,000 | 91,106 | - | 111,106 | ||||||||

| Andrea R. Lindell | 82,000 | 66,023 | - | 148,023 | 82,000 | 91,106 | - | 173,106 | ||||||||

| Thomas P. Rice | 87,500 | 66,023 | - | 153,523 | 89,500 | 91,106 | - | 180,606 | ||||||||

| Donald E. Saunders | 104,500 | 66,023 | - | 170,523 | 91,500 | 91,106 | - | 182,606 | ||||||||

| George J. Walsh III | 235,500 | 66,023 | - | 301,523 | 245,000 | 91,106 | - | 336,106 | ||||||||

| Frank E. Wood | 82,000 | 66,023 | - | 148,023 | 82,000 | 91,106 | - | 173,106 | ||||||||

| (a) | The Director Compensation Table excludes executive compensation figures for Messrs. McNamara and Hutton who are employees of the Company. |

| (b) | Amounts for each of Messrs. |

Directors Emeriti

The Board of Directors has a policy of conferring the honorary designation of Director Emeritus upon former directors who made valuable contributions to the Company and whose continued advice is believed to be of value to the Board of Directors. The designation as Director Emeritus is customarily conferred by the Board on an annual basis but may be conferred at such other times and for such other periods as the Board may determine. Each Director Emeritus is furnished with a copy of all agendas and other materials furnished to members of the Board of Directors generally, and is invited to attend all meetings of the Board; however, a Director Emeritus is not entitled to vote on any matters presented to the Board. A Director Emeritus is paid an annual fee of $18,000 and $500 for each meeting attended.

Ms. Laney, who served as a director of the Company from 1986-2009, was initially designated a Director Emeritus in May 2009 and has been so designated in each subsequent May. In 2015,2018, the Company paid Ms. Laney $20,500$20,000 in cash fees, $6,000 in Capital Stock deposited to the Director Deferred Compensation Plan, and granted her $60,023$85,106 in the form of a fully vested stock award of 493255 shares of Capital Stock in her capacity as a Director Emeritus.

Majority Voting in Director Elections

The Company’s bylaws require a majority voting standard for uncontested elections of directors. As described above under “Elections,“Election of Directors,” each director must receive the affirmative vote of the majority of the votes cast to be elected in an uncontested election. Each incumbent director nominee has submitted an irrevocable letter of resignation as director that becomes effective if he or she does not receive the affirmative vote of the majority of the votes cast in an uncontested election and the Board of Directors accepts the resignation. In contested elections, each director must receive a plurality of the votes cast. An election is contested if (a) a stockholder has nominated any person(s) for election to the Board of Directors in compliance with our bylaws or otherwise in accordance with applicable law and (b) such nomination has not been withdrawn on or prior to the fourteenth day prior to the date the Company first mails its notice of meeting.

11

Committees and Meetings of the Board

The Company has the following Committees of the Board of Directors: Audit Committee, Compensation Committee and Nominating Committee.

Audit CommitteeThe Audit Committee (a) is directly responsible for the appointment, compensation and oversight of a firm of independent registered accountants to audit the consolidated financial statements of the Company, (b) reviews and reports to the Board of Directors on the Company’s annual financial statements and the independent accountants’ report on such financial statements, (c) meets with the Company’s senior financial officers, internal auditors and independent accountants to review audit plans and work regarding the Company’s accounting, financial reporting and internal control systems and other non-audit services, and (d) confers quarterly with senior management, internal audit staff and the independent accountants to review quarterly financial results. Each member of the Audit Committee is independent as defined under the listing standards of the New York Stock Exchange. The Committee conducts an annual self-evaluation that is shared with the Board. A copy of the Audit Committee Charter is available on the Company’s Web site, www.chemed.com.

Compensation CommitteeThe executive compensation program is administered by the Compensation Committee. The Compensation Committee makes recommendations to the Board of Directors concerning (a) base salary and annual cash incentive compensation for executives of the Company, (b) establishment of incentive compensation plans and programs generally, (c) adoption and administration of certain employee benefit plans and programs, and (d) additional year-end contributions by the Company under the Chemed/Roto-Rooter Savings & Retirement Plan (as amended, supplemented or otherwise modified as of the date hereof, the “Retirement Plan”)., and (e) non-employee director compensation. In addition, the Compensation Committee administers the 20062010 Incentive Plan, the 20102015 Incentive Plan, and the 20152018 Stock Incentive Plan (the “Stock Incentive Plans”), under which it reviews and approves the granting of cash, stock options and stock awards.performance share units. The Compensation Committee determines annually whether to retain or terminate any compensation advisor, after considering specific independence factors. It is directly responsible for the appointment, compensation and oversight of such advisor. Each member of the Compensation Committee is independent as defined under the listing standards of the New York Stock Exchange. The Committee conducts an annual self-evaluation that is shared with the Board. A copy of the Compensation Committee Charter, as revised in 2018, is available on the Company’s Web site, www.chemed.com.

Nominating CommitteeThe Nominating Committee (a) recommends to the Board of Directors the candidates for election to the Board at each Annual Meeting of Stockholders of the Company, (b) recommends to the Board of Directors candidates for election by the Board to fill vacancies on the Board, (c) considers candidates submitted to the Nominating Committee by directors, officers, employees, stockholders and others, and (d) performs such other functions as may be assigned by the Board.The Nominating Committee Chair leads the annual Board evaluation and the self-evaluation of the Nominating Committee, which is shared with the Board.

Procedures Regarding Director Candidates In identifying and evaluating nominees for director, the Nominating Committee considers candidates with a wide variety of academic backgrounds and professional and business experiences. After reviewing the candidates’ backgrounds and qualifications, the Nominating Committee personally interviews those candidates it believes merit further consideration. Once it has completed this process, the Nominating Committee makes its final recommendations to the Board. Stockholders wishing to submit a candidate for election to the Board should submit the candidate’s name and a supporting statement to the Company’s Secretary at Suite 2600, 255 East Fifth Street, Cincinnati, Ohio 45202-4726. The Nominating Committee has no formal policy with regard to the consideration of director candidates recommended by stockholders because it believes such recommendations are sufficiently rare that they may be effectively considered on a case-by-case basis. The Nominating Committee considers diversity in identifying nominees. It assesses the effectiveness of the Company’s diversity policy every year as part of the nomination process for the annual election of directors by the Company stockholders. The Committee is committed to including, in the initial list of candidates from which new director nominees are chosen by the Board, candidates with a diversity of race, ethnicity and gender. Having reviewed the collective background and experience of all nominees, the Board has concluded they provide significant diversity. Its policy is to select the most appropriate candidatecandidates for election. Board membership should reflect diversity in its broadest sense, including geography, gender, race, experience, professions, skills and backgrounds. The Nominating Committee does not assign specific weights to particular criteria. The background and qualifications of all directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that allow the Board to fulfill its responsibilities. Each member of the Nominating Committee is independent as defined under the listing standards of the New York Stock Exchange. A copy of the Nominating Committee Charter is available on the Company’s Web site, www.chemed.com.www.chemed.com.

12

The following table shows the current membership of each committee and the number of meetings held by each committee during 2015:2018:

Director | Audit Committee | Compensation Committee | Nominating Committee | Audit Committee | Compensation Committee | Nominating Committee |

J. F. Gemunder P. P. Grace* W. L. Krebs A. R. Lindell T. P. Rice* D. E. Saunders* G. J. Walsh III F. E. Wood | x x Chair | x x Chair x | x Chair x | |||

J. F. Gemunder P. P. Grace* W. L. Krebs A. R. Lindell T. P. Rice* D. E. Saunders* G. J. Walsh III F. E. Wood | Chair x x | x x Chair x | x Chair x | |||

| Number of Meetings | 7 | 4 | 1 | 7 | 4 | 1 |

*Audit Committee Financial Expert as defined by Securities and Exchange Commission regulations.

Board MeetingsThe Board of Directors has five scheduled meetings a year, at which it reviews and discusses reports by management on the performance of the Company and its operating subsidiaries, its plans and properties, as well as immediate issues facing the Company. The Board also meets during its meetings in executive session, without executives or management directors present. Such sessions are presided over by the Chairman of the Board.

During 2015,2018, there were five meetings of the Board of Directors and one meetingtwo meetings of the Executive Committee.

Each director attended at least 80% of the Board meetings and his or her applicable Committee meetings. While the Company does not have a formal policy with regard to Board members’ attendance at the Annual Meeting of Stockholders, all members of the Board are encouraged to attend. All members of the Board attended last year’s Annual Meeting of Stockholders held on May 18, 2015.21, 2018.

Director IndependenceThe Board and the Nominating Committee undertake an annual review of director and nominee independence. They consider transactions and relationships between each director or nominee or any member of such director’s or nominee’s immediate family or any other person sharing such director’s or nominee’s home and the Company and its subsidiaries and affiliates, including those reported under the heading “Transactions With Related Persons” below. The Board and the Nominating Committee also examine transactions and relationships between directors and nominees and their respective affiliates and members of the Company’s senior management and their affiliates. The purpose of this review is to determine whether any such relationships or transactions are inconsistent with a determination that the director or nominee is independent under the New York Stock Exchange corporate governance listing standards.

As a result of its 2016most recent review, the Board and the Nominating Committee affirmatively determined that, under the New York Stock Exchange listing standards, the following directors and nominees, constituting a majority of the individuals nominated for election as directors at the Annual Meeting, are independent of the Company and its management: Messrs. Gemunder, Grace, Krebs, Rice, Saunders, Walsh and Wood and Ms. Lindell.

Risk Oversight The Board receives periodic reports from management on matters involving risk exposures such as regulatory changes, material litigation, cybersecurity, and recommended policy revisions.

Management maintains a formal Enterprise Risk Management (ERM)(“ERM”) program that monitors management’s actions in response to the key risks facing the Company. The Audit Committee reviews various aspects of the ERM program periodically throughout the year. It oversees our risk identification and mitigation process. It reviews material financial risk exposures including regulatory matters, acquisitions, cyber security,cybersecurity, economic conditions and interest rate exposures. Members of our management, including our Chief Financial Officer, Chief Legal Officer, Vitas Compliance Officer, and our Director of Internal Audit, report to the Audit Committee regarding on-going risk management process activities. The Audit Committee also reviews legal matters that may have a material impact on the Company’s financial statements. These Audit Committee reviews are conducted on at least an annual basis, or more frequently if a significant risk exposure matter develops.

13

While the Board has responsibility for the Company’s risk oversight, management is responsible for day-to- dayday-to-day risk management processes. We believe this division of responsibilities most effectively addresses the risks we face, and that our Board leadership structure supports this approach.

Compensation Risk Management has reviewed the compensation policies and practices for our employees and has concluded that they do not create risks that are reasonably likely to have a material adverse effect on us.

The Compensation Committee oversees our risks related to compensation programs and philosophy. It ensures our compensation programs do not encourage excessive risk taking. Determining incentive awards based on a variety of performance metrics diversifies the risk associated with any one performance indicator. The mix of fixed and variable, annual and long-term, and cash and equity compensation is also designed to encourage actions in the Company’s long-term best interests. The Committee works periodically with our independent compensation consultant to ensure our executive compensation plans are appropriately balanced and incentivize management to act in the best interests of our stockholders.

As described in more detail below under “Compensation Discussion and Analysis,”Analysis”, long-term compensation programs for our named executive officers have been structured such that long-term compensation is linked to our long- termlong-term relative and absolute performance. This model of linking long-term compensation to our performance applies not only to our named executive officers, but has also been applied to other senior corporate personnel. We believe that our compensation plans reflect sound risk management practices and do not encourage excessive or inappropriate risk taking.

Compensation Committee Interlocks and Insider ParticipationThe Compensation Committee is comprised of Messrs. Walsh, Krebs and Wood and Ms. Lindell. No member of the Compensation Committee has any direct or indirect material interest in or relationship with the Company, other than holdings of Capital Stock as set forth under the heading “Security Ownership of Certain Beneficial Owners and Management” below and as related to his or her position as a director. During 2015,2018, no executive officer of the Company served on the compensation committee of any other entity where an executive officer of such entity also served on the Board of Directors, and no executive officer of the Company served on the board of directors of any other entity where an executive officer of such entity also served on the Compensation Committee.

Board Leadership Structure The Board has separated the functions of CEOChief Executive Officer and Chairman of the Board. Mr. Walsh currently serves as Chairman. The Board believes this separation of function promotes independence and enhances corporate governance.

Related Person Policies and ProceduresThe Audit Committee reviews all material transactions with related persons as identified by management. In February 2007, the Audit Committee adopted a written policy and set of procedures for reviewing transactions between the Company and related persons, who include directors, nominees, executive officers and any person known to be the beneficial owner of more than 5% of the Company’s voting securities (each, a “related person”), any immediate family member of a related person and any person sharing the household of a related person. The policy also covers any firm, corporation or other entity in which any related person is employed or is a partner or principal, or in which such related person has a 5% or greater beneficial ownership interest. Prior to entering into a transaction with a related person, notice must be given to the Secretary of the Company containing (a) the related person’s relationship to the Company and interest in the transaction, (b) the material facts of the transaction, (c) the benefits to the Company of the transaction, (d) the availability of any other sources of comparable products or services, and (e) an assessment of whether the transaction is on terms comparable to those available to an unrelated third party. If the Company’s Secretary and Chief Financial Officer determine that it is a related party transaction exceeding $100,000, the proposed transaction is submitted to the Audit Committee for its approval. The policy also provides for the quarterly review of related person transactions which have not previously been approved or ratified and any other such transactions which come to the attention of the Company’s Chief Executive Officer, Chief Financial Officer, Controller or Secretary. If the transaction is pending or ongoing, it will be promptly submitted to the Audit Committee for approval. If the transaction is completed, it will be submitted to the Audit Committee to determine if ratification or rescission is appropriate. This policy also covers charitable contributions or pledges by the Company to non-profit organizations identified with a related person.

14

Code of Ethics The Board of Directors has adopted Corporate Governance Principles and Policies on Business Ethics, which, along with the charters of the Audit, Compensation and Nominating Committees, are available on the Company’s Web site under Corporate Governance — Governance Documents (www.chemed.com). Printed copies may be obtained from the Company’s Secretary at Suite 2600, 255 East Fifth Street, Cincinnati, Ohio 45202- 4726.45202-4726.

Stockholder Communications Stockholders and others wishing to communicate with members of the Board should mail such communications to the Company’s Secretary at Suite 2600, 255 East Fifth Street, Cincinnati, Ohio 45202-4726. The Secretary will forward these communications to the Board and, if applicable, to specified individual directors.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis explains the material elements of the compensation of the Company’s named executive officers. The Company’s named executive officers for 20152018 are Kevin J. McNamara, President and Chief Executive Officer; David P. Williams, Executive Vice President and Chief Financial Officer; Timothy S. O’Toole,Nicholas M. Westfall, Executive Vice President; Spencer S. Lee, Executive Vice President; and Arthur V. Tucker, Jr.,Naomi C. Dallob, Vice President, Secretary and Controller.Chief Legal Officer.

Consideration of the 20152018 Say On Pay Vote

Following our 20152018 Annual Meeting of Stockholders, the Compensation Committee and the Board of Directors reviewed the results of the non-binding stockholder advisory vote on our executive compensation (“20152018 Say On Pay Vote”). Stockholders voted in favor of Say On Pay, with 79.48%95.50% positive votes, 19.76%4.09% negative votes and .76% abstentions..40% abstentions (percentages rounded to nearest hundredth of a percent). Based on the significantstrong favorable vote and with input solicited from Company stockholders, the Compensation Committee and Board maintained the significant changes adopted in 2013 to ourits executive compensation policies and practices, as followsthat include the following changes from earlier practices (abbreviated terms are defined within)below):

| Replacement of the previous annual incentive program, which was based on a multiple of historical growth rates in Adjusted EPS applied to prior year actual payouts, with a target bonus plan based on achieving goals related to Adjusted EPS and Return on Assets; |

| Replacement of the previous long-term incentive plan with performance share units subject to performance-based vesting related to a cumulative three-year Adjusted EPS target and a three-year relative TSR performance metric. Prior to 2013, time-based restricted stock awards generally cliff vested on the fourth anniversary of the grant date; |

| A policy that, beginning in 2013, stock incentive compensation is subject to a “double trigger” in the event of a change in control of the Company. New incentives vest only upon employment termination without good cause or for good reason after a change in control; and |

| A clawback policy such that the Compensation Committee will review all performance-based compensation awarded to, or earned by, certain officers during the three-year period prior to any restatement of the Company’s financial results. If the Compensation Committee determines such compensation would have been lower had it been calculated based on the restated financial statement, the Compensation Committee may seek to recover the excess amount. |

| ● | Additionally, in 2018, the Board of Directors amended The Senior Executive Severance Policy and the Change in Control Plan to limit any gross-up payments payable under the plans to the then-existing participants in the plans. |

15

Overview of Compensation Program

The executive compensation program is administered by the Compensation Committee. The membership of the Compensation Committee is comprised of four independent directors. The Compensation Committee is responsible for the review, approval and recommendation to the Board of Directors of matters concerning (a) base salary and annual cash incentive compensation for executives of the Company, (b) establishment of incentive compensation plans and programs generally, (c) adoption and administration of certain employee benefit plans and programs, and (d) additional year-end contributions by the Company under the Retirement Plan. The recommendations of the Compensation Committee on such matters must be approved by the non-employee members of the Board of Directors. The employee members of the Board of Directors are not present when compensation recommendations are presented to the Board of Directors and discussed, and such members do not vote on compensation issues. The Compensation Committee also administers the Stock Incentive Plans. Under authority granted it by those plans, it reviews and approves the granting of stock options and stock awards.performance share units. The Compensation Committee also annually determines whether to retain or terminate the services of independent compensation consultants to assist and advise it in administering the executive compensation program after considering certain independence factors. Currently, Compensation Strategies, Inc., an independent compensation advisory firm, has been retained by, and reports directly and exclusively to, the Compensation Committee. The scope of these consulting services is limited to (a) advising the Compensation Committee regarding executive compensation, (b) performing studies of general market and peer group compensation levels, and (c) advising the Board on director compensation, all upon request of the Compensation Committee. Compensation Strategies, Inc. does no other work for the Company outside of providing these compensation advisory services.

How Compensation Decisions Are Made

Generally, in February of each year, certain senior executives of the Company, including the Chief Executive Officer, prepare recommendations for annual cash incentives to be made to Company employees, based on the performance of the Company and its subsidiaries during the past year. Beginning in 2013,For the past five years, the Compensation Committee granted stock option awards in November, to more fully reflect the Company’s financial and stock price performances during that year. Beginning in 2019, the Compensation Committee will grant stock option awards on the day of the release of the Company’s third quarter earnings results. The recommendations made by the Chief Executive Officer and other senior executives to the Compensation Committee, which include detailed memoranda and tally sheets, take into consideration historical compensation, including base salaries, annual incentive compensation and long-term equity awards, performance of the Company as a whole, and performance of the individual business unit for which the employee is responsible. The Compensation Committee then meets to determine the long-term equity awards for each executive and to review and consider the recommendations prepared by the Company’s senior executives in order to determine the recommendations that the Compensation Committee will make to the non-employee members of the Board of Directors with respect to the amount of incentives for each executive. The Compensation Committee makes compensation recommendations to the non-employee members of the Board of Directors regarding the compensation of the Chief Executive Officer without the input of any Company employees. The Compensation Committee can modify any recommendations of the Company’s senior executives.

Base salaries of executives are periodically reviewed by the Compensation Committee and approved by the non-employee members of the Board of Directors. As a component of the review and approval process, the Compensation Committee and the non-employee members of the Board consider the recommendations of the Chief Executive Officer and certain senior executives of the Company as to the base salaries of Company executives, other than the Chief Executive Officer. The Chief Executive Officer’s base salary is reviewed and determined without the input of Company employees. In determining recommended base salaries for the Company’s executives, as more fully discussed under “Base Salaries” below, the Compensation Committee also considers each executive’s then-current base salary and thetheir individual performance of each executive.

The Compensation Committee directly grants compensation under the Stock Incentive Plans.

16

Role of Executive Officers

The Chief Executive Officer and certain other senior executives of the Company provide recommendations to the Compensation Committee concerning compensation of Company executives, other than the Chief Executive Officer. Additionally, as part of its process, the Compensation Committee meets with the Chief Executive Officer to obtain input with respect to compensation decisions, including the performance of the Company’s senior executives other than the Chief Executive Officer. In addition to meeting with the Chief Executive Officer, the Compensation Committee meets in executive session without any Company employees present.

Objectives of Compensation Program

The Company’s executive compensation program is intended to achieve the objectives of aligning executives’ interests with those of its stockholders by rewarding the executives for long-term growth in the value of the Capital Stock and encouraging them to hold a significant amount of the Company’s equity; paying for performance through both cash and equity-based incentives that, in turn, provide greater rewards for stronger performance of the Company as a whole and the Company’s business units; paying competitively in order to attract and retain senior executives; and creating incentive to maximize the long-term growth of the Company’s business. To achieve these objectives, the elements of executive compensation are designed to reward past performance and establish incentive for future growth.

Elements of Compensation

The elements of the Company’s executive compensation program are: base salary, annual cash incentive compensation and long-term incentive compensation in the forms of stock option awards, restricted share awards, and performance share units.units, and certain perquisites. Components of compensation that are available generally to all Company employees, including the Company’s named executive officers, are defined contribution plans and welfare benefit plans (including life insurance, health insurance, dental insurance and long-term disability benefits). In addition, the Chemed Corporation Excess Benefit Plan (as amended, supplemented or otherwise modified as of the date hereof, the “Excess Benefit Plan”), the Chemed Corporation Long Term Care Insurance Plan, the Chemed Corporation Supplemental Pension and Life Insurance Plan (as amended, supplemented or otherwise modified as of the date hereof, the “Supplemental Pension Plan”), the Chemed Corporation Supplemental Severance Benefit Plan (as amended, supplemented or otherwise modified as of the date hereof, the “1986 Severance Plan”) and the Roto-Rooter Deferred Compensation Plan (as amended, supplemented or otherwise modified as of the date hereof, the “Deferred Compensation Plan”) are available as components of compensation to executives and other highly compensated individuals. Base salary, annual cash incentive compensation and pension and welfare benefit plans are established by the non-employee members of the Board based on the levels that the Compensation Committee and such Board members determine are competitive and are intended to reward executives for current and past performance, while longer-term incentives, such as stock option awards and performance share unit awards are intended to create incentive for future growth. The Company’s executive compensation program also offers perquisites commonly available to senior executives.

Executive Compensation Consultant

The Compensation Committee’s charter grants it sole authority regarding the appointment, compensation and oversight of the Company’s executive compensation consultant. The Compensation Committee retained Compensation Strategies, Inc., after considering specific independence factors, as its consultant to assist the Compensation Committee with its responsibilities related to the Company’s compensation program for its executives and Board of Directors. During 2013, Compensation Strategies, Inc. advised the Compensation Committee and assisted in the development of the Company’s revised management compensation program. The consultant was instrumental in (i) establishing a new peer group against which to benchmark executive compensation, (ii) developing annual incentive compensation target goals and target bonus percentages by executive, (iii) setting Adjusted EPS and Return on Assets payout percentages by performance level, (iv) establishing three-year goals for Adjusted EPS CAGR and relative TSR performance share units, and (v) implementing the Company’s clawback provision and “double trigger” regarding incentives in the event of a change in control of the Company. During 2015,On a periodic basis, the Company’s executive compensation consultant provides the Compensation Strategies, Inc. assisted inCommittee with a review of Board compensationexecutive compensation. The most recent review included base salary, annual bonus, and long-term incentives for 16 individuals and the review and monitoring of the revised management compensation program.Chief Executive Officer.

The Compensation Committee assessed the independence factors set forth in applicable SEC rules and other facts and circumstances in February 20162019 and concluded that the services performed by Compensation Strategies, Inc. did not raise any conflicts of interest.

Peer Group

In conjunction with its review of the management compensation program, and in consultation with Compensation Strategies, Inc., the Compensation Committee revisedreviewed the peer group used to benchmark executive compensation during 2013. During 2015 Gentivia Health Services, Inc. and Skilled Healthcare Group, Inc. were removed from the group as they were acquired.compensation. The Peer Group is now as follows:

ABM Industries, Inc. | Five Star | |

Acadia Healthcare Co., Inc. | ||

Healthcare Services Group | ||

Amedisys, Inc. | LHC Group, Inc. | |

Bioscrip, Inc. | Mednax, Inc. | |

Brookdale Senior Living, Inc. | National Healthcare Corp. | |

Capital Senior Living Corp. | Radnet, Inc. | |

Clean Harbors, Inc. | Rollins, Inc. | |

Comfort Systems USA, Inc. | Team, Inc. | |

Ensign Group, Inc. | Tetra Tech, | |

Tivity Health, Inc. |

The Compensation Committee reviewed a comparison of the Company’s annual revenues and market capitalization to those in the Peer Group.

The Compensation Committee began tracking the Company’s relative TSR performance against the new peer groupPeer Group as of the end of 2013. The Company’s Capital Stock hit record levels in 2015,2018, rising from a low of $100.49$243.68 per share to a high of $160.12.$335.99. It was priced at $149.80$283.29 a share at year end.

Amount of Each Element of Compensation; Decisions Concerning Payments

The Compensation Committee intends compensation to be linked directly to personal performance and to the Company’s overall results, as well as to the results of the specific business units for which executives are responsible. The Company’s executive compensation program is focused on rewarding superior operating performance and long- termlong-term growth.

The Compensation Committee meets as often as necessary in order to carry out its duties. In 2015,2018, the Compensation Committee met four times. The Compensation Committee periodically reviews each executive’s total compensation, including base salary, annual cash incentive compensation, stock option awards, restricted stock awards and stock performance unit awards, and perquisites and defined contribution plan holdings (including the amounts contributed to such plans by the Company), as well as such executive’s Capital Stock holdings, in recommending or setting, as applicable, each element of compensation. The Compensation Committee balances the types of compensation for each executive between fixed compensation and performance-based compensation in such a way that less robust Company performance will result in a lower total compensation to the executive. For 2015,2018, about 6472.9 percent of Mr. McNamara’s total compensation was performance-based, while the average for the other named executive officers was about 6070.2 percent. “Performance-based” compensation includes non-equitynon equity incentive awards, option awards and performance share units.

Base Salaries